Americans face a choice between credit card (debt consolidation vs balance transfer) debt consolidation and balance transfer options as nearly 83% of them make debt repayment their priority this year. The average American carries almost $8,000 in credit card debt, making economical solutions crucial right now. The situation looks even more pressing since almost 53% of Americans pay over half their monthly income just for housing, which leaves them with less money for other expenses and pushes them toward more credit card debt.

Balance transfers look attractive with their zero interest for up to 21 months, while debt consolidation loans come with fixed interest rates between 10-15% – substantially lower than regular credit card rates that exceed 20%. The math tells an interesting story. Take someone with $10,000 in credit card debt at 22% APR. They would pay about $3,748 in interest over three years. A personal loan at 13% APR would cost just $2,129 in interest, saving them over $1,600. But there’s a catch. Balance transfer fees usually run 3-5%, and many people who unite their debt end up with credit card balances back at pre-consolidation levels within 18 months. The real question becomes: which choice will save you more money in 2025?

Understanding the Basics: Balance Transfer vs Debt Consolidation

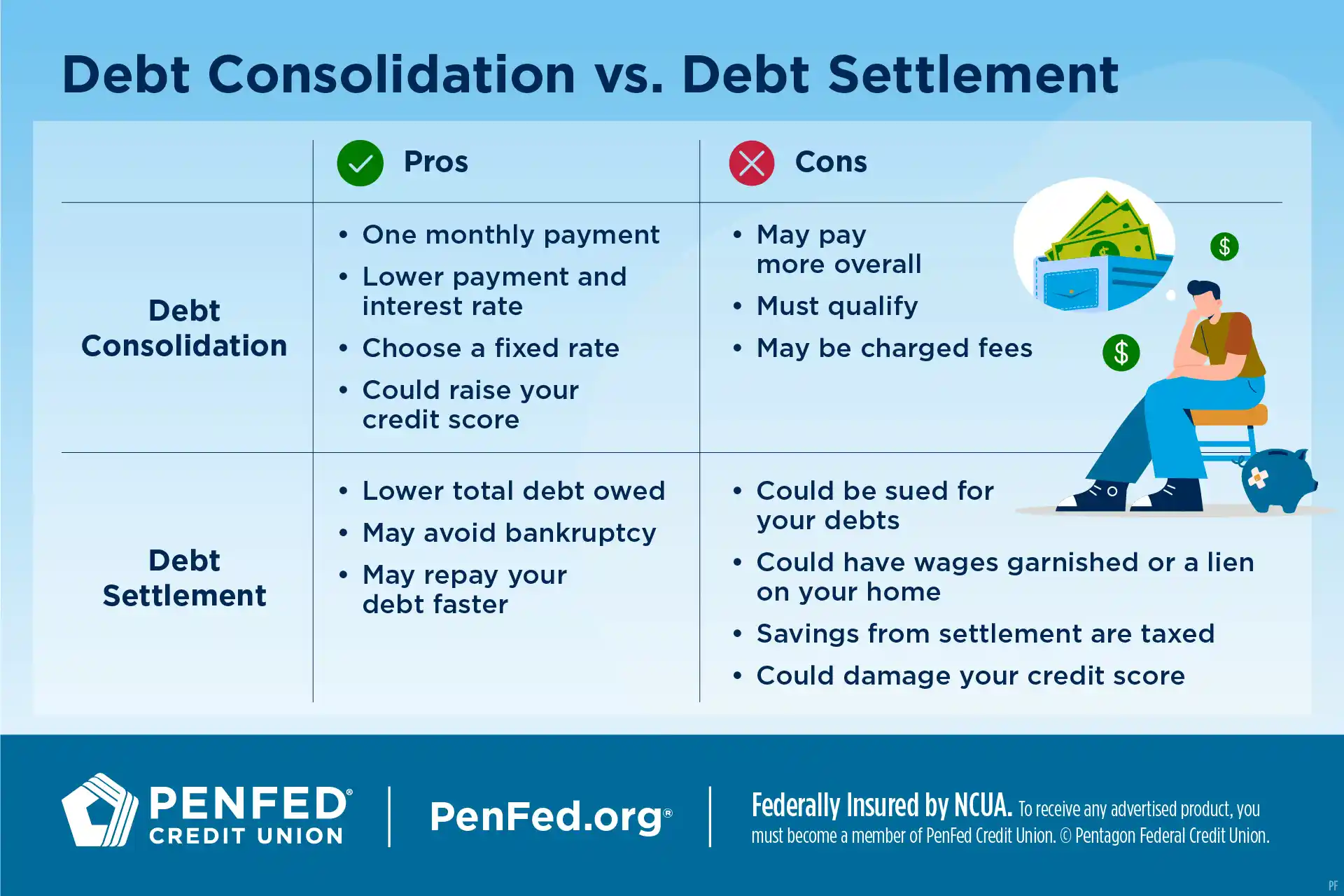

Image Source: PenFed Credit Union

Let’s look at the basic differences between two popular ways to handle debt. People who need to deal with high-interest credit card debt often look at balance transfers or debt consolidation loans as ways to get out of debt.

What is a balance transfer and how does it work?

A balance transfer moves your outstanding debt from one or more credit cards to another card that usually comes with a lower promotional interest rate. Credit card companies offer introductory 0% APR periods that last between 6 and 21 months. You won’t pay any interest on transferred balances during this time, which means every dollar you pay reduces your actual debt.

You’ll need to complete the transfer quickly, usually within two months after opening the new account. Most cards charge a fee of 3% to 5% of the amount you transfer. To cite an instance, if you move $5,000 from a card with 15% APR to one with 0% promotional APR, you could save about $265 in interest, even after paying the transfer fees.

How debt consolidation loans simplify repayment

Debt consolidation loans give you a lump sum of money to pay off multiple unsecured debts at once. Once you’ve paid off existing debts, you make one fixed monthly payment on the new loan. These loans usually need to be paid back in one to seven years.

Most debt consolidation loans are unsecured personal loans with fixed interest rates from 6% to 36%, based on your credit score. Lenders might charge origination fees between 1% and 10% of what you borrow. You can typically borrow anywhere from $1,000 to $50,000, and some lenders offer up to $100,000.

Key differences between revolving and installment credit

The main difference between these options comes down to their credit structure. Balance transfers use revolving credit, which lets you repeatedly use and pay back money up to your credit limit. Credit cards show how revolving credit works—you can pay different amounts each month based on what you owe.

Debt consolidation loans work differently as installment credit, giving you one lump sum with set repayment terms. Unlike revolving accounts, your monthly payments stay the same until you’ve paid off the loan.

Your credit utilization affects your credit scores a lot, but this mainly applies to revolving accounts. Missing payments on either type of credit hurts your score, but how you handle revolving credit tends to matter more because it shows how well you manage changing expenses and plan your finances.

Cost Comparison: Which Option Saves More in 2025?

Image Source: Verified Market Research

The numbers tell a clear story about how these two options affect your finances. Let’s look at the specific costs to help you save more money in 2025.

Interest savings: 0% APR vs fixed loan rates

These options have very different interest structures. Balance transfer cards come with 0% introductory APRs that last 12 to 18 months. Your payments during this time directly reduce your debt. The rates jump substantially after the promotional period ends and can go above 20%.

Debt consolidation loans work differently. They have fixed rates between 6% and 36%, based on your credit score. People with excellent credit might get rates under 7%. Right now, the average personal loan rate sits at 12.46%. This is a big deal as it means that someone with $10,000 in credit card debt at 22% APR would pay $3,748 in interest over three years. The same person would pay just $2,129 with a personal loan at 13% APR—putting $1,600 back in their pocket.

Balance transfer fees vs loan origination fees

Balance transfer cards usually take 3% to 5% of the transferred amount as fees. Moving $10,000 costs you $300 to $500 right away.

Loan origination fees range from 1% to 10% of the borrowed amount. People with good credit scores often pay less than balance transfer fees. Some lenders even skip these fees entirely.

Monthly payment comparison: short-term vs long-term

Balance transfers give you flexible monthly minimums but need discipline to clear the debt before promotional rates end. Consolidation loans provide predictable monthly payments that stay the same until you pay off the loan.

Remember this: consolidation loans don’t let you make minimum payments. This might not work well if your income changes month to month.

Total repayment cost: 18 months vs 5 years

Balance transfers save you more money in shorter timeframes, especially if you pay everything during the 0% period. For 5-year repayment plans, consolidation loans often work out cheaper overall, even though interest starts immediately.

Your credit score makes a huge difference. Excellent credit (720-850) gets you personal loan rates around 13.88%. Fair credit (630-689) pushes those rates up to about 19.77%.

When Each Option Makes the Most Sense

Your financial situation determines whether debt consolidation or balance transfer makes more sense. Each option works better in different cases based on your timeline, debt amount, and credit profile.

Best for short-term payoff: Balance transfer scenarios

Balance transfer cards work great if you can pay off debt within a set timeframe. You’ll get the most value by paying the entire balance during the intro period, which usually lasts 15-21 months. These cards are a perfect fit for smaller debt amounts that you can eliminate before the promotional rate ends. People with excellent credit and enough income to make bigger monthly payments will see the best results. Let’s say you have $15,000 in credit card debt at 22% APR – moving it to a 0% card would mean monthly payments of about $861 to clear everything within an 18-month promotional period.

Best for long-term budgeting: Debt consolidation use cases

Debt consolidation loans give you structure with fixed payments over longer periods. These loans make sense if you need one to seven years to clear larger debt amounts. Many people like consolidation loans because their payments stay the same month after month. On top of that, they help if you want longer repayment terms with lower monthly payments—about $297 monthly for a $15,000 debt over five years at 7% interest.

How credit score affects your eligibility and savings

Credit scores have a big effect on your options. Balance transfers usually need good to excellent credit scores (690+), and the average approved score is 727. Debt consolidation loans are available to people with various credit scores, including fair credit. Your credit score directly relates to interest rates—excellent credit might get you rates under 7%, while fair credit could mean rates close to 20%.

Discover card debt consolidation loans vs Citi balance transfer card

Discover personal loans focus on debt consolidation and come with no annual fees. Meanwhile, Citi Simplicity Card gives you one of the longest intro periods for balance transfers without late fees. Your payoff timeline should guide your choice between these options rather than brand preference.

Risks, Credit Impact, and Long-Term Considerations

Image Source: LoansJagat.com

Money matters go beyond the here and now when you look at debt consolidation and balance transfer options. You need to know these risks to make better choices about your financial future.

How each option affects your credit score

A hard inquiry happens when you apply for a balance transfer card or consolidation loan. This usually takes less than five points off your credit score. The long-term impact looks quite different though. Your credit can improve with debt consolidation loans. These loans lower your utilization ratio and create a better credit mix. Balance transfers might boost your score if you keep your old accounts open. However, new cards can hurt your credit over time if you open too many.

Risk of accumulating new debt after consolidation

A 2023 TransUnion survey revealed something worrying. People who took personal loans to unite their debts saw their credit card balances bounce back to previous levels in just 18 months. This shows a big problem: moving debt around won’t fix it unless you change how you spend money.

What happens if you miss payments?

Late payments create a domino effect of problems. Your score can drop by 110 points with just one missed payment. Most creditors will double your normal rate after 60 days – they call this penalty APR. Your account moves to collections after six months without payment. This black mark stays on your credit report for seven years.

Behavioral traps: Spending habits post-consolidation

The biggest problem comes from seeing consolidation as the answer instead of a tool. Many people clear their credit cards through consolidation and feel relieved. Then they rack up new balances. You might end up in worse shape than before if you don’t stick to a realistic budget. You could have both consolidation payments and fresh credit card debt. Good debt management needs more than restructuring – it demands a complete change in how you handle money.

Comparison Table

|

Feature |

Balance Transfer |

Debt Consolidation Loans |

|---|---|---|

|

Interest Rates |

0% APR for 12-21 months (promotional), 20%+ after promotion ends |

6-36% fixed APR (average 12.46%) |

|

Typical Fees |

3-5% transfer fee |

1-10% origination fee |

|

Payment Structure |

Variable monthly minimums |

Fixed monthly payments |

|

Typical Term Length |

12-21 months (promotional period) |

1-7 years |

|

Credit Score Requirements |

Good to excellent (690+), average approval score 727 |

Available to borrowers of all credit levels, including fair credit |

|

Loan/Transfer Amounts |

Not specifically mentioned |

$1,000 to $50,000 (up to $100,000 with select lenders) |

|

Best Suited For |

Short-term payoff, smaller debt amounts |

Long-term budgeting, larger debt amounts |

|

Credit Impact |

Credit score dips briefly from hard inquiry, score can improve when old accounts remain open |

Brief score decrease from hard inquiry, potential improvement in utilization ratio and credit mix |

|

Risk Factors |

High interest rates take effect after promotional period |

Credit card balances might return to pre-consolidation levels within 18 months |

|

Example Savings |

$265 on $5,000 transfer (after fees) |

$1,600 on $10,000 over 3 years (13% APR vs 22% credit card APR) |

Conclusion

Your specific financial situation and debt repayment timeline will determine whether you should choose debt consolidation loans or balance transfers. Both options can help you get relief from high-interest credit card debt in 2025.

Balance transfers work best if you have smaller debt amounts and can pay off your balances within the promotional period. You might save a lot of money with this approach, especially with promotional periods that last up to 21 months. The zero interest during this time lets you tackle your principal debt head-on.

Debt consolidation loans give you a more structured path when you have larger debt loads or need more time to repay. These loans come with predictable fixed monthly payments and often have lower interest rates than standard credit cards. People who need several years to clear their debt usually do better with consolidation loans, even though interest starts right away.

Your credit score plays a big role in what options you can get. People with scores above 690 usually qualify for the best offers for both options. Those with fair credit might find it easier to get consolidation loans than premium balance transfer cards.

Final Thoughts:

Both strategies come with their risks. Credit card balances often return to pre-consolidation levels within 18 months. This shows that you need to change your spending habits – debt restructuring alone won’t fix the problem. Real financial success comes from changing your behavior while restructuring your debt.

Missing payments can hurt badly. Your credit score could drop by 110 points or more after just one late payment. That’s why you need to pick an option that fits your budget.

The math favors balance transfers for short-term payoff and consolidation loans for longer-term plans. Let’s say you have $10,000 in credit card debt at 22% APR. You could save over $1,600 by using a consolidation loan at 13% APR instead of making minimum payments on the original card.

Take time to look at your debt amount, repayment timeline, credit profile, and spending habits before you decide. The best approach combines debt restructuring with real changes to your budget to keep debt from piling up again. A good debt management strategy needs to handle both your current financial pressure and your long-term financial health.

FAQ

Q1. Which option is better for short-term debt repayment: balance transfer or debt consolidation?

Balance transfers are generally better for short-term debt repayment, especially if you can pay off the entire balance during the promotional period (typically 12-21 months). They work best for smaller debt amounts and for individuals with excellent credit who can make aggressive monthly payments.

Q2. How does credit score affect eligibility for balance transfers and debt consolidation loans?

Credit scores significantly impact eligibility and terms. Balance transfers typically require good to excellent credit scores (690+), with an average approved score of 727. Debt consolidation loans are more accessible across the credit spectrum, including for those with fair credit, but interest rates correlate directly with credit scores.

Q3. What are the risks of accumulating new debt after consolidation?

A major risk is accumulating new debt after consolidation. Studies show that many consumers see their credit card balances return to pre-consolidation levels within 18 months. Without addressing underlying spending habits, consolidation may simply shuffle debt rather than eliminate it.

Q4. How do balance transfers and debt consolidation loans affect credit scores?

Initially, both options may cause a temporary credit score dip due to hard inquiries. Long-term, debt consolidation loans can improve your credit by lowering your utilization ratio and diversifying your credit mix. Balance transfers may improve your score if you keep old accounts open, but repeatedly opening new cards can damage your credit over time.

Q5. What happens if you miss payments on a balance transfer or debt consolidation loan?

Missing payments on either option can have severe consequences. A single missed payment can drop your credit score by up to 110 points. After 60 days, most creditors apply penalty APRs, often doubling your normal rate. After six months of nonpayment, accounts typically enter charge-off status and move to collections, remaining on your credit report for seven years.

You might also like: How to Get a Loan with Bad Credit in 2025: A Simple Step-by-Step Guide

References

[1] – https://www.cbsnews.com/news/balance-transfer-or-debt-consolidation-better-right-now-experts-weigh-in/

[2] – https://www.cnbc.com/select/debt-consolidation-pros-cons/

[3] – https://www.citi.com/personal-loans/learning-center/basics/balance-transfer-vs-personal-loan

[4] – https://www.consolidatedcredit.org/financial-news/effects-of-missed-payments/

[5] – https://www.nerdwallet.com/article/loans/personal-loans/debt-consolidation-credit-card-balance-transfer

[6] – https://www.experian.com/blogs/ask-experian/revolving-vs-installment-credit/

[7] – https://www.investopedia.com/ask/answers/110614/what-are-differences-between-revolving-credit-and-installment-credit.asp

[8] – https://www.cnbc.com/select/which-should-you-have-revolving-credit-or-installment-credit/

[9] – https://www.bankrate.com/loans/personal-loans/balance-transfer-credit-card-vs-personal-loan/

[10] – https://blog.harvardfcu.org/debt-consolidation-loan-or-balance-transfer-know-your-options

[11] – https://www.cnbc.com/select/how-to-choose-between-loan-and-zero-percent-apr-card-for-debt/

[12] – https://www.nerdwallet.com/calculator/personal-loan-calculator

[13] – https://www.nerdwallet.com/best/credit-cards/balance-transfer

[14] – https://www.experian.com/blogs/ask-experian/pros-and-cons-of-debt-consolidation/

[15] – https://www.iwillteachyoutoberich.com/pros-and-cons-of-debt-consolidation/

[16] – https://www.equifax.com/personal/education/credit-cards/articles/-/learn/balance-transfers-impact-credit-score/

[17] – https://www.greenpath.com/blog/debt/debt-consolidation-loan-or-balance-transfer/

[18] – https://www.creditninja.com/faq/what-happens-if-you-dont-pay-debt-consolidation-loans/

![No Win No Fee Lawyers: The Hidden Truth About Settlement Cuts Legal representation through no win no fee lawyers gives clients a way to fight cases without paying anything upfront. Many clients don't know that these services take a big chunk of money after winning the case. Lawyers usually take 25% to 40% of what you win as their contingency fee. The amount lawyers take from settlements can add up fast. A $100,000 settlement means your attorney gets $30,000 if they charge a 30% fee after winning your case. Your solicitor's cut might be £10,000 from a £30,000 compensation award, based on your agreement percentage. This payment model stays pretty much the same for no win no fee lawyers in different places, though percentages can change. This piece breaks down what you need to know about contingency fee deals. You'll learn about standard fee ranges, extra costs beyond the basic fee, and times when this payment setup might not work in your favor. Smart clients should think over these money matters before signing up with a lawyer to make better choices about their legal help. What No-Win No-Fee Really Means Image Source: Express Legal Funding A no-win no-fee arrangement, also called a Conditional Fee Agreement, changes the way people get legal help. This payment approach removes the need to pay legal fees upfront and creates a partnership between clients and their attorneys. How contingency fees work No-win no-fee agreements are based on contingency fees. Lawyers get paid only when they win compensation for their clients. Most lawyers take between 25% and 40% of the final amount, based on how complex the case is and where it's filed. Lawyers take their cut after winning the case. To name just one example, see a case where a lawyer wins £30,000 in compensation with a 33% fee - they would receive £10,000. On top of that, some law firms use sliding scales where they charge less for quick settlements and more if the case goes to trial. The law requires a written agreement before any work starts. This paperwork spells out the lawyer's percentage, what costs you'll need to cover, and other key details. What happens if you lose the case The meaning behind "no-win no-fee" is clear - losing your case means you won't pay your lawyer anything. All the same, you should know about a few money-related details. You won't owe your lawyer when you lose, but some deals might make you pay for court fees, expert witnesses, or other case expenses. The other side could also ask you to pay their legal costs. Many lawyers suggest getting "After Event" insurance to protect their clients. These policies cover any costs if you lose your case, which makes the no-win no-fee setup much safer. Why lawyers offer this model Lawyers want to make legal help available to more people, so they offer these payment plans. This setup helps people who don't have much money take legal action when they have valid claims. The payment structure motivates lawyers to work hard. They only get paid by winning cases, which pushes them to get the best results possible. Lawyers carefully assess each case before taking it on a no-win no-fee basis. They usually accept cases that have a good chance of winning, since they put in lots of time and resources without any guaranteed payment. The Real Cost: How Much Do Lawyers Take from a Settlement Image Source: Greiner Law Corp. The true cost of no-win no-fee legal representation becomes clear once we look at contingency fees. Many clients feel surprised to see a big chunk of their settlement checks going to their attorney's fees. Typical percentage ranges (25%–40%) No win no fee lawyers typically ask for 25% to 40% of the total settlement amount. Personal injury attorneys usually take 33.3% (one-third) of the awarded compensation[101]. Lawyers and clients agree on this percentage before any work starts on the case. Several factors shape the final percentage. Your chances of winning, case complexity, and the work to be done play key roles in determining the attorney's cut. Some areas have laws that cap the maximum contingency fees for specific types of cases. Sliding scale based on case complexity Law firms often use a tiered fee system that changes with the case stage and complexity. This scale rewards quick settlements while paying attorneys fairly if more work becomes needed. The fee might start at 30% if the case settles before lawsuit filing. This number could climb to 35% after filing or reach 40% if the case goes to trial. Law firms often group cases by complexity: 10%-20%: Simple cases with straightforward settlements 25%-35%: Typical personal injury cases 35% and above: Complex cases requiring extensive resources Examples of payout breakdowns These ground examples show how fees affect settlements: A $15,000 settlement with a 33.3% contingency fee.pdf) puts $5,000 in the attorney's pocket, leaving $10,000 for the client. Similarly, from a $100,000 settlement with a 33% fee, the attorney gets $33,000 while the client receives $67,000[102]. Complex cases tell a different story. A $100,000 settlement with a 30% fee plus $5,000 in extra costs leaves $65,000 for the client after all deductions. These fees substantially change the client's final payout. Hidden Costs You Might Not Expect Image Source: Nelson Personal Injury Lawyers Beyond percentage-based fees, clients often feel surprised by extra costs that can reduce their final compensation by a lot. These hidden costs show up in the fine print of no-win no-fee agreements. You should think over these details before signing. Court filing and expert witness fees Legal proceedings come with unavoidable court filing fees. These charges differ by jurisdiction. They usually range from $30 for small claims to several hundred dollars for complex civil lawsuits. Expert witnesses can be expensive, with hourly rates ranging from $150 to $1,000 based on their credentials and testimony complexity. Expert witnesses charge more for court appearances than consultation work because of added pressure and prep time. Clients might still need to pay experts for their prep work even if the case settles before trial. Medical report and investigation costs Medical documentation is a vital part of many legal claims. These costs include fees to release medical records, create specialized reports, and prepare documents. Investigation costs cover evidence gathering, police reports, witness interviews, and other fact-finding work needed to build a strong case. Of course, some firms say they'll cover these expenses upfront, but clients don't completely avoid these costs. When these costs are deducted from your compensation Law firms take these expenses from the settlement amount before they calculate their percentage fee, though each firm handles this differently. Some lawyers subtract these costs after figuring out their contingency fee, which changes how much money clients end up with. Most firms pay case-related costs during the process and get their money back from the settlement. The defendant usually pays most simple legal costs and disbursements in successful cases, but not always everything. Insurance protects clients from costs in unsuccessful claims at many law firms, but this protection isn't guaranteed. Clients should review their agreements carefully since they might still need to pay specific expenses even if they lose their case. When No-Win No-Fee Might Not Be the Best Option Contingency fee arrangements give many people access to justice. However, this payment model doesn't always work in a client's best interests. Knowing these limitations helps clients make better decisions about their legal representation. Cases with unclear liability Lawyer no win no fee arrangements work best in cases where fault is clear. We assessed the probability of success before taking contingency cases. Lawyers might turn down cases if there isn't enough evidence of the other party's negligence or if liability isn't certain. Cases with multiple responsible parties create more challenges. The situation gets complicated fast when several parties share liability. Lawyers are less likely to take these cases on contingency. They need to be confident they can prove the other party's negligence before accepting a case. Low-damage or low-payout claims Small claims often don't work well with the contingency model, even with real injuries. Cases that have minimal injuries or limited financial damages might not bring enough compensation to cover legal costs. The potential settlement needs to be big enough to pay for investigations, witness interviews and court fees. Personal injury lawyers often turn down cases where the "compensation potential" is too small. This doesn't mean the claim isn't valid - it just means the economics don't add up for a contingency arrangement. Situations where hourly billing may be better Hourly billing has clear advantages in certain cases. Clients see exactly what they're paying for - every hour worked and task completed. This model works well for cases that need lots of attention but don't have clear financial outcomes. Complex litigation with opposing parties works better with hourly billing and a retainer fee. Clients have more control over their case and don't feel pressured to settle quickly. Cases that need extensive preparation but have uncertain outcomes fit the hourly model better. Lawyers can spend the time needed without worrying about contingency limits. This approach often leads to better representation, especially for complex legal issues that need special expertise. Conclusion Understanding the Full Picture Before You Sign No-win no-fee arrangements offer legal representation without upfront costs. Of course, this seems attractive at first glance. In spite of that, you need to think about how these agreements can affect your final compensation. Legal fees usually range from 25% to 40% of your settlement - but that's just the start. You'll face more deductions like court filing fees, expert witness costs, and charges for medical documentation. What looks like a "free" service ends up taking a big chunk of your compensation to cover legal expenses. These arrangements work best in specific situations - cases with obvious liability, substantial damages, and solid evidence. If you have a low-value claim or complex liability issues, traditional hourly billing might serve you better. Without doubt, you should ask for clear explanations of all possible costs before signing anything. Read the fine print closely, especially when you have to deal with expenses in unsuccessful cases. Ask to see sample settlement breakdowns that show all deductions. This helps you picture what you might actually take home. Your choice to go with a no-win no-fee arrangement depends on your situation. This model helps if you don't have money to pursue valid claims. But if you have a strong case and enough funds, other fee structures might let you keep more of your compensation. Whatever payment model you choose, knowing exactly how much lawyers take from settlements helps you make better decisions. This knowledge lets you approach legal representation with real expectations and better control over your money. FAQs Q1. What percentage of a settlement do no-win no-fee lawyers typically take? No-win no-fee lawyers typically charge between 25% to 40% of the final settlement amount as their contingency fee. The exact percentage often depends on the complexity of the case and the stage at which it is resolved. Q2. Are there any hidden costs in no-win no-fee arrangements? Yes, there can be additional costs beyond the lawyer's percentage fee. These may include court filing fees, expert witness costs, medical report expenses, and investigation costs. These expenses are usually deducted from the settlement amount before or after the lawyer's fee is calculated. Q3. What happens if I lose my case in a no-win no-fee arrangement? If you lose your case, you generally won't have to pay your lawyer's fees. However, you might still be responsible for certain expenses like court costs or the opposing party's legal fees. Many lawyers offer insurance to protect clients from these potential costs in case of an unsuccessful claim. Q4. When might a no-win no-fee arrangement not be the best option? No-win no-fee arrangements may not be ideal for cases with unclear liability, low-value claims, or complex legal issues requiring extensive preparation. In these situations, traditional hourly billing might be more appropriate and potentially more cost-effective for the client. Q5. Can I negotiate the percentage a lawyer takes from my settlement? Yes, the contingency fee percentage is often negotiable. It's typically agreed upon and formalized in writing before the lawyer begins working on your case. Don't hesitate to discuss the fee structure with your lawyer and ask for a detailed breakdown of potential costs and deductions.](https://consumersweek.com/wp-content/uploads/2025/06/No-Win-No-Fee-Lawyers-The-Hidden-Truth-About-Settlement-Cuts-870x570.webp)