Looking to enhance your property’s worth without breaking the bank? These 10 genius home improvement hacks offer cost-effective solutions to boost your home’s value instantly.

Smart house upgrades aren’t just about keeping up with the Joneses anymore – they’re serious investments that can dramatically boost your property value.

In fact, while basic home improvement projects might add modest value, specific smart upgrades can push your home’s worth up by $10,000 or more. The real estate market in 2025 specifically rewards homes equipped with modern technology and energy-efficient features.

Whether you’re planning to sell or simply want to enhance your living space, these 15 genius home upgrades deliver both immediate benefits and long-term value. From smart kitchen remodels to EV charging stations, we’ll show you exactly which improvements offer the biggest bang for your buck.

1) Smart Kitchen Remodel.

Image Source: Virginia Kitchen & Bath

A kitchen remodel stands as one of the most impactful house upgrades, particularly when incorporating smart technology. The average kitchen remodel in 2025 requires an investment between $14,500 and $42,000, making it crucial to understand the cost-benefit relationship.

Kitchen Remodel Cost Breakdown

The financial allocation typically follows a structured pattern. Labor, including plumbing, electrical, and framing, consumes about one-third of the budget, while finishes and installation each claim another third. Cabinetry represents the largest single expense at 29% of the total cost, followed by appliances at 17% and countertops at 11%.

Smart Appliance Integration

Modern kitchens now feature voice-controlled devices and Wi-Fi-enabled appliances that streamline cooking and cleaning processes . Smart refrigerators equipped with touchscreens can display recipes and manage grocery lists, while connected ovens allow remote temperature control and monitoring.

Modern Cabinet and Countertop Updates

For maximum value, focus on durable materials and timeless designs. Flat-panel or shaker-style cabinets offer clean lines that appeal to modern tastes. Additionally, quartz or granite countertops provide both durability and esthetic appeal, with costs averaging $3,250 for granite installation.

Expected Value Increase

A minor kitchen remodel delivers an impressive 96% return on investment, making it a financially sound improvement. Moreover, updated kitchens rank among the top five elements that help homes sell above asking price. Subsequently, smart kitchen features particularly appeal to modern buyers, potentially increasing your home’s marketability and value.

2) Heat Pump HVAC System

Image Source: Total Home Supply

Modern homeowners seeking energy-efficient house upgrades are turning to heat pump HVAC systems for substantial returns. These systems offer a remarkable blend of efficiency and value enhancement.

Energy Efficiency Benefits

Heat pumps deliver exceptional energy performance, reducing electricity usage by 50% compared to traditional heating systems. Furthermore, these systems cut household carbon emissions by 36-64% nationwide. A recent study reveals that 92% of American homes could lower their utility bills through heat pump installation.

Installation Costs

The investment range for heat pump systems varies based on capacity and type:

- Standard Installation: USD 6,083 average cost

- Premium Systems: USD 8,000 to USD 30,000 for whole-house coverage

- Additional Costs: Ductwork modifications range from USD 3,000 to USD 7,500

Long-term Savings

The financial benefits accumulate steadily over time. Homeowners save between USD 300 to USD 650 annually on utility bills. Consequently, properties with heat pumps in colder climates often experience the most significant savings . The system’s efficiency remains consistent, with a lifespan of 12-20 years.

Value Addition to Modern Buyers

Heat pumps significantly boost property value, adding between USD 10,400 to USD 17,000 to home worth. As a result, these systems offer a compelling return on investment, increasing property values by up to 7%. Notably, the federal government provides a 30% tax credit up to USD 2,000 through 2032, making this upgrade even more attractive to potential buyers.

3) Solar Panel Installation

Image Source: Angie’s List

Solar panel installations represent one of the most financially rewarding house upgrades, delivering both immediate savings and long-term value. A typical residential solar system costs between $15,000 to $25,000 before incentives.

Initial Investment

The upfront cost primarily depends on system size and quality. A standard 5kW system ranges from $6,000 to $10,000 for panels alone. Installation costs, including labor and permits, add another $5,000 to $10,000. Therefore, homeowners should plan for comprehensive costs that include mounting hardware and grid connection expenses.

Energy Cost Savings

Monthly utility savings make solar panels a compelling investment. Households generally save $1,500 annually on electricity bills. Overall, the total savings over a system’s lifetime can range between $31,000 and $100,000. The payback period typically spans 7 to 10 years, after which all generated power essentially becomes free.

Government Incentives

The federal solar tax credit offers substantial savings:

- 30% tax credit through 2032

- 26% credit in 2033

- 22% credit in 2034

Resale Value Impact

Solar installations significantly boost property value. Homes with solar panels sell for 6.8% more than comparable properties. Based on current median home values, this translates to approximately $28,000 in added value. The premium varies by location, with high-demand regions seeing increases up to 5.4%.

4) Smart Home Security System

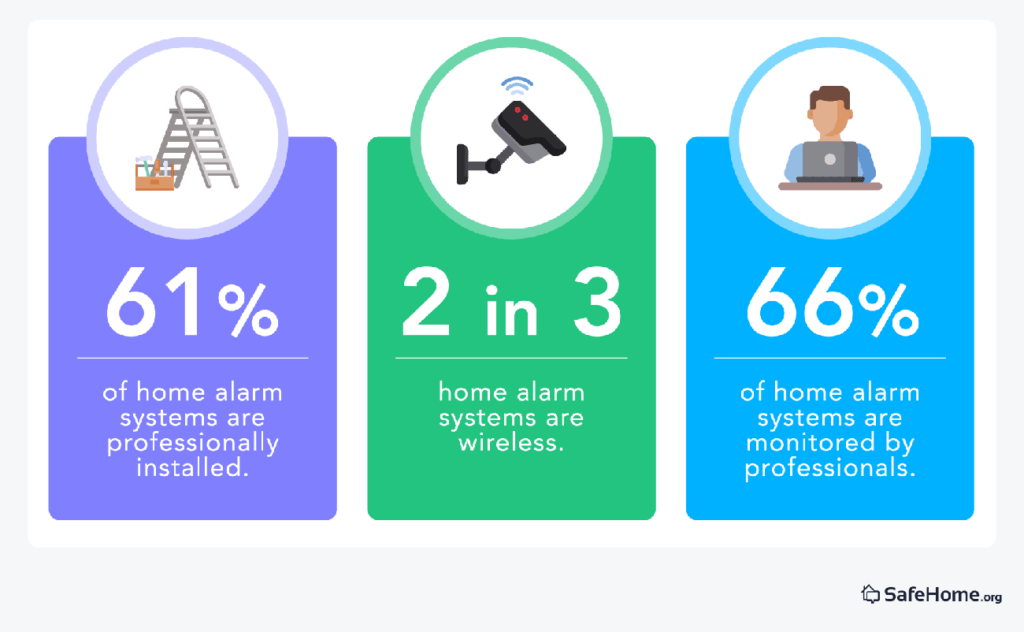

Image Source: SafeHome.org

Security systems have emerged as essential house upgrades that blend advanced technology with practical protection. A comprehensive smart security system adds substantial value to modern homes, with 78% of homebuyers willing to pay more for properties equipped with these features.

Modern Security Features

Advanced security systems now offer real-time monitoring through smartphone apps, enabling homeowners to oversee their property from anywhere. These systems primarily include smart cameras with night vision, motion sensors, and automated alerts [24]. Rather than relying on traditional methods, modern setups provide two-way audio communication and remote access control.

Integration Capabilities

Smart security systems simultaneously connect with other home automation devices through Wi-Fi, Z-Wave, or Zigbee protocols. Accordingly, these systems can trigger automated responses – lights activate when motion is detected, or doors automatically lock when the security system is armed.

Cost vs Value Analysis

The initial investment varies based on coverage needs:

- Entry-level systems start with basic door sensors and motion detectors

- Professional installation and monitoring services range from $70 monthly

- Home insurance providers offer discounts up to 5% for properties with smart security

Buyer Appeal Factor

Properties with smart security features experience a value increase of up to 5%, albeit varying by location. Undoubtedly, during property viewings, these systems demonstrate a commitment to safety and innovation, making homes more attractive to potential buyers. The presence of integrated security features has become a decisive factor in real estate transactions.

5) Luxury Bathroom Renovation

Image Source: Titan Bathworks

Bathroom renovations rank among the highest-yielding house upgrades, delivering a national average return on investment of 72.7%. Beyond that, luxury bathroom remodels transform everyday spaces into premium sanctuaries.

High-end Fixture Options

Premium bathrooms now feature sophisticated elements like frameless glass shower enclosures and rainfall shower-heads. Primarily, high-end fixtures include:

- Digital faucets with precise temperature control

- Freestanding soaking tubs

- Custom cabinetry with stone countertops

- Premium flooring with radiant heat options

Smart Technology Integration

Modern bathrooms incorporate voice-activated systems and digital controls. Indeed, smart mirrors display weather updates and news feeds, likewise offering touch-screen controls and LED lighting. Smart showers remember preferred temperature settings, similarly providing customized experiences for each family member.

Space Optimization

Effective space utilization enhances both functionality and value. Above all, proper layout planning ensures smooth circulation while maximizing storage. Strategic placement of fixtures, coupled with wall-mounted options, creates an open, accessible environment.

Return on Investment

Upscale bathroom renovations typically recoup 60.2% of costs For minor cosmetic changes, homeowners see a $1.71 increase in home value for every dollar spent. The Pacific region leads with an 87.7% return on midrange remodels, averaging $21,855 in costs with $19,378 recouped.

6) Energy Efficient Windows

Replacing outdated windows with energy-efficient alternatives ranks among the most transformative house upgrades. Recent innovations in window technology have revolutionized how homes manage temperature and energy consumption.

Window Technology Advances

Advanced window designs now incorporate remarkable materials like aerogels, which are ultra-porous substances lighter than marshmallows yet strong enough to support bricks. These innovations reduce heat loss by up to 65%. Primarily, modern windows feature multiple glass panes with argon or krypton gas fills, alongside low-emissivity coatings that reflect infrared and ultraviolet light.

Installation Costs

The investment for energy-efficient windows ranges between USD 300 to USD 1,000 per window. A complete home installation typically costs between USD 6,685 and USD 33,425. Triple-pane windows, although more expensive at USD 400 to USD 3,540 per unit, offer superior insulation benefits.

Energy Savings

These upgrades deliver substantial utility savings. Homeowners can expect to reduce their annual energy bills by 7% to 15%, translating to USD 71 to USD 501 in yearly savings. Hence, windows with proper Energy Star certification can decrease heating and cooling energy loss by 25-30%.

Property Value Impact

Energy-efficient windows boost property resale value significantly. Homeowners typically recoup 68.5% of their investment, approximately USD 13,766 in added home value. Although the upfront costs may seem substantial, the combination of energy savings and increased property value makes this upgrade particularly attractive to future buyers.

7) Smart Garage Door System

Smart garage door systems stand among the most practical house upgrades, offering advanced security and unmatched convenience. These systems transform standard garage doors into intelligent entry points that homeowners can monitor and control remotely.

Security Features

Modern smart garage systems employ rolling code technology that changes access codes after each use, preventing unauthorized entry. Primarily, these systems include motion detection alerts and real-time notifications whenever the door opens or closes. In addition to basic security, many models feature built-in cameras with night vision capabilities, offering comprehensive surveillance of your garage space.

Remote Access Benefits

Smart garage systems enable complete control through smartphone apps, allowing homeowners to monitor and operate their garage doors from anywhere. The system sends instant notifications about door status and can automatically close the door if left open. Furthermore, these devices permit temporary access codes for service providers or package deliveries, with approximately 1.7 million packages stolen daily making this feature especially valuable.

Installation Requirements

Setting up a smart garage system typically involves connecting a hub to your existing opener, provided it was manufactured after 1993. The installation process includes:

- Mounting the smart hub near the opener

- Connecting to home Wi-Fi network

- Installing door sensors

- Setting up smartphone app integration

For optimal performance, the hub should be placed within range of a strong Wi-Fi signal. Ultimately, while DIY installation is possible, professional setup ensures proper integration with home automation systems and optimal security configuration.

8) Home Office Conversion

Converting spare rooms into home offices has become a priority for property owners, with 85% of workers preferring hybrid work arrangements. Currently, this house upgrade requires careful planning to maximize both functionality and value.

Design Considerations

Creating an effective home office primarily focuses on separation from living spaces. A dedicated workspace, preferably with a separate entrance path and sound-proofing insulation, ensures productivity. Nevertheless, full-on office conversions should maintain flexibility, since removing bedroom features like closets can limit future use and reduce property value .

Technology Infrastructure

A robust technical foundation supports remote work success. Essential components include:

- High-speed internet with redundant connections

- Secure VPN access for data protection

- Cloud-based collaboration platforms

- Multi-factor authentication systems

Certainly, proper infrastructure setup extends beyond basic connectivity. Remote workers need reliable power systems, adequate lighting, and ergonomic furniture to maintain productivity.

Value for Remote Workers

The financial impact of home office conversions varies significantly. Eventually, these upgrades recoup approximately 45% of the investment. However, self-employed individuals can benefit from tax advantages, with deductions available for:

- USD 5.00 per square foot up to 300 square feet using the simplified method

- Percentage-based deductions for mortgage interest, utilities, and insurance using the regular method

For employed remote workers, while direct tax deductions aren’t available through 2025, 56% of companies offer reimbursement for work equipment , making this upgrade financially advantageous for many professionals.

9)Outdoor Kitchen Addition

Image Source: DIY Playbook

Outdoor kitchens have emerged as premium house upgrades, with average costs ranging between USD 5,400 and USD 22,000. Currently, these additions serve as complete entertainment stations that expand living space while boosting property value.

Design Elements

Proper layout planning starts with positioning the kitchen within 10 feet of the house for utility access. Primarily, the design should incorporate distinct zones for cooking, prep, and dining areas. Durable materials like stainless steel for appliances and stone for countertops ensure longevity.

Equipment Selection

A well-equipped outdoor kitchen requires:

- Built-in gas grill as the centerpiece

- Compact refrigerator for beverages

- Power burners for stock pots

- Pizza ovens for versatile cooking

- Storage solutions for utensils

Weather Considerations

Protecting the investment demands thoughtful weather-proofing. Stainless steel cabinets resist moisture, while HDPE (High-Density Polyethylene) offers superior durability against elements. Ultimately, adding a pergola or roof structure extends usability throughout the year.

Entertainment Value

Outdoor kitchens boost property values by 6.8% to 7%. Beyond monetary benefits, these spaces create ideal settings for social gatherings. Properties with upgraded backyards sell for 24.5% more than those without exterior improvements. Presently, outdoor kitchens rank as one of the most desired features among homebuyers seeking enhanced lifestyle amenities .

10) Smart Lighting System

Image Source: Goldmedal

Intelligent lighting systems fundamentally transform living spaces, with LED technology reducing energy consumption by 75% compared to traditional bulbs. Currently, these house upgrades offer both immediate cost savings and enhanced home functionality.

Energy Efficiency

Smart LED lighting delivers substantial utility savings through automated adjustments. These systems monitor surrounding environments, dimming automatically when natural light is sufficient. Primarily, the technology extends bulb lifespan to 20,000 hours, equivalent to seven years of daily eight-hour usage.

Automation Features

Modern lighting systems incorporate advanced capabilities:

- Motion detection for automatic operation

- Daylight-based brightness adjustment

- Voice control compatibility with major platforms

- Scheduled routines for different times of day

Installation Process

Setting up smart lighting begins with ensuring Wi-Fi connectivity and choosing compatible devices. The process requires careful consideration of existing wiring configurations. Ultimately, most installations involve either replacing traditional bulbs with smart alternatives or upgrading to smart switches that maintain power for continuous automation.

Smart lighting systems integrate seamlessly with home automation hubs, enabling coordinated responses with security systems and thermostats. Evidently, these upgrades appeal to potential buyers, contributing to increased property values while reducing monthly energy costs by up to 50% through efficient LED technology and automated controls.

Conclusion

By applying these home improvement hacks, you can significantly increase your home’s value and appeal to potential buyers.

Smart house upgrades deliver substantial returns through enhanced functionality, energy savings, and increased property values. Rather than viewing these improvements as mere expenses, homeowners benefit from both immediate lifestyle enhancements and long-term financial gains.

These strategic upgrades consistently demonstrate strong ROI potential. Smart kitchens return 96% of investments, while premium flooring installations yield up to 118% returns. Additionally, energy-efficient features like heat pumps and solar panels reduce monthly utility costs while adding $10,000 to $28,000 in property value.

Smart home technology adoption rates continue climbing, making these upgrades increasingly valuable. Buyers actively seek properties equipped with automated systems, security features, and energy-efficient components. Properties featuring multiple smart upgrades command premium prices, often selling faster than traditional homes.

Ultimately, smart house upgrades represent sound investments that enhance daily living while building lasting value. Careful selection and implementation of these improvements position homeowners for success in both current and future real estate markets.

For more budget-friendly renovation ideas, check out our article on Small Changes, Big Impact: Budget-Friendly Home Improvement Ideas.

![No Win No Fee Lawyers: The Hidden Truth About Settlement Cuts Legal representation through no win no fee lawyers gives clients a way to fight cases without paying anything upfront. Many clients don't know that these services take a big chunk of money after winning the case. Lawyers usually take 25% to 40% of what you win as their contingency fee. The amount lawyers take from settlements can add up fast. A $100,000 settlement means your attorney gets $30,000 if they charge a 30% fee after winning your case. Your solicitor's cut might be £10,000 from a £30,000 compensation award, based on your agreement percentage. This payment model stays pretty much the same for no win no fee lawyers in different places, though percentages can change. This piece breaks down what you need to know about contingency fee deals. You'll learn about standard fee ranges, extra costs beyond the basic fee, and times when this payment setup might not work in your favor. Smart clients should think over these money matters before signing up with a lawyer to make better choices about their legal help. What No-Win No-Fee Really Means Image Source: Express Legal Funding A no-win no-fee arrangement, also called a Conditional Fee Agreement, changes the way people get legal help. This payment approach removes the need to pay legal fees upfront and creates a partnership between clients and their attorneys. How contingency fees work No-win no-fee agreements are based on contingency fees. Lawyers get paid only when they win compensation for their clients. Most lawyers take between 25% and 40% of the final amount, based on how complex the case is and where it's filed. Lawyers take their cut after winning the case. To name just one example, see a case where a lawyer wins £30,000 in compensation with a 33% fee - they would receive £10,000. On top of that, some law firms use sliding scales where they charge less for quick settlements and more if the case goes to trial. The law requires a written agreement before any work starts. This paperwork spells out the lawyer's percentage, what costs you'll need to cover, and other key details. What happens if you lose the case The meaning behind "no-win no-fee" is clear - losing your case means you won't pay your lawyer anything. All the same, you should know about a few money-related details. You won't owe your lawyer when you lose, but some deals might make you pay for court fees, expert witnesses, or other case expenses. The other side could also ask you to pay their legal costs. Many lawyers suggest getting "After Event" insurance to protect their clients. These policies cover any costs if you lose your case, which makes the no-win no-fee setup much safer. Why lawyers offer this model Lawyers want to make legal help available to more people, so they offer these payment plans. This setup helps people who don't have much money take legal action when they have valid claims. The payment structure motivates lawyers to work hard. They only get paid by winning cases, which pushes them to get the best results possible. Lawyers carefully assess each case before taking it on a no-win no-fee basis. They usually accept cases that have a good chance of winning, since they put in lots of time and resources without any guaranteed payment. The Real Cost: How Much Do Lawyers Take from a Settlement Image Source: Greiner Law Corp. The true cost of no-win no-fee legal representation becomes clear once we look at contingency fees. Many clients feel surprised to see a big chunk of their settlement checks going to their attorney's fees. Typical percentage ranges (25%–40%) No win no fee lawyers typically ask for 25% to 40% of the total settlement amount. Personal injury attorneys usually take 33.3% (one-third) of the awarded compensation[101]. Lawyers and clients agree on this percentage before any work starts on the case. Several factors shape the final percentage. Your chances of winning, case complexity, and the work to be done play key roles in determining the attorney's cut. Some areas have laws that cap the maximum contingency fees for specific types of cases. Sliding scale based on case complexity Law firms often use a tiered fee system that changes with the case stage and complexity. This scale rewards quick settlements while paying attorneys fairly if more work becomes needed. The fee might start at 30% if the case settles before lawsuit filing. This number could climb to 35% after filing or reach 40% if the case goes to trial. Law firms often group cases by complexity: 10%-20%: Simple cases with straightforward settlements 25%-35%: Typical personal injury cases 35% and above: Complex cases requiring extensive resources Examples of payout breakdowns These ground examples show how fees affect settlements: A $15,000 settlement with a 33.3% contingency fee.pdf) puts $5,000 in the attorney's pocket, leaving $10,000 for the client. Similarly, from a $100,000 settlement with a 33% fee, the attorney gets $33,000 while the client receives $67,000[102]. Complex cases tell a different story. A $100,000 settlement with a 30% fee plus $5,000 in extra costs leaves $65,000 for the client after all deductions. These fees substantially change the client's final payout. Hidden Costs You Might Not Expect Image Source: Nelson Personal Injury Lawyers Beyond percentage-based fees, clients often feel surprised by extra costs that can reduce their final compensation by a lot. These hidden costs show up in the fine print of no-win no-fee agreements. You should think over these details before signing. Court filing and expert witness fees Legal proceedings come with unavoidable court filing fees. These charges differ by jurisdiction. They usually range from $30 for small claims to several hundred dollars for complex civil lawsuits. Expert witnesses can be expensive, with hourly rates ranging from $150 to $1,000 based on their credentials and testimony complexity. Expert witnesses charge more for court appearances than consultation work because of added pressure and prep time. Clients might still need to pay experts for their prep work even if the case settles before trial. Medical report and investigation costs Medical documentation is a vital part of many legal claims. These costs include fees to release medical records, create specialized reports, and prepare documents. Investigation costs cover evidence gathering, police reports, witness interviews, and other fact-finding work needed to build a strong case. Of course, some firms say they'll cover these expenses upfront, but clients don't completely avoid these costs. When these costs are deducted from your compensation Law firms take these expenses from the settlement amount before they calculate their percentage fee, though each firm handles this differently. Some lawyers subtract these costs after figuring out their contingency fee, which changes how much money clients end up with. Most firms pay case-related costs during the process and get their money back from the settlement. The defendant usually pays most simple legal costs and disbursements in successful cases, but not always everything. Insurance protects clients from costs in unsuccessful claims at many law firms, but this protection isn't guaranteed. Clients should review their agreements carefully since they might still need to pay specific expenses even if they lose their case. When No-Win No-Fee Might Not Be the Best Option Contingency fee arrangements give many people access to justice. However, this payment model doesn't always work in a client's best interests. Knowing these limitations helps clients make better decisions about their legal representation. Cases with unclear liability Lawyer no win no fee arrangements work best in cases where fault is clear. We assessed the probability of success before taking contingency cases. Lawyers might turn down cases if there isn't enough evidence of the other party's negligence or if liability isn't certain. Cases with multiple responsible parties create more challenges. The situation gets complicated fast when several parties share liability. Lawyers are less likely to take these cases on contingency. They need to be confident they can prove the other party's negligence before accepting a case. Low-damage or low-payout claims Small claims often don't work well with the contingency model, even with real injuries. Cases that have minimal injuries or limited financial damages might not bring enough compensation to cover legal costs. The potential settlement needs to be big enough to pay for investigations, witness interviews and court fees. Personal injury lawyers often turn down cases where the "compensation potential" is too small. This doesn't mean the claim isn't valid - it just means the economics don't add up for a contingency arrangement. Situations where hourly billing may be better Hourly billing has clear advantages in certain cases. Clients see exactly what they're paying for - every hour worked and task completed. This model works well for cases that need lots of attention but don't have clear financial outcomes. Complex litigation with opposing parties works better with hourly billing and a retainer fee. Clients have more control over their case and don't feel pressured to settle quickly. Cases that need extensive preparation but have uncertain outcomes fit the hourly model better. Lawyers can spend the time needed without worrying about contingency limits. This approach often leads to better representation, especially for complex legal issues that need special expertise. Conclusion Understanding the Full Picture Before You Sign No-win no-fee arrangements offer legal representation without upfront costs. Of course, this seems attractive at first glance. In spite of that, you need to think about how these agreements can affect your final compensation. Legal fees usually range from 25% to 40% of your settlement - but that's just the start. You'll face more deductions like court filing fees, expert witness costs, and charges for medical documentation. What looks like a "free" service ends up taking a big chunk of your compensation to cover legal expenses. These arrangements work best in specific situations - cases with obvious liability, substantial damages, and solid evidence. If you have a low-value claim or complex liability issues, traditional hourly billing might serve you better. Without doubt, you should ask for clear explanations of all possible costs before signing anything. Read the fine print closely, especially when you have to deal with expenses in unsuccessful cases. Ask to see sample settlement breakdowns that show all deductions. This helps you picture what you might actually take home. Your choice to go with a no-win no-fee arrangement depends on your situation. This model helps if you don't have money to pursue valid claims. But if you have a strong case and enough funds, other fee structures might let you keep more of your compensation. Whatever payment model you choose, knowing exactly how much lawyers take from settlements helps you make better decisions. This knowledge lets you approach legal representation with real expectations and better control over your money. FAQs Q1. What percentage of a settlement do no-win no-fee lawyers typically take? No-win no-fee lawyers typically charge between 25% to 40% of the final settlement amount as their contingency fee. The exact percentage often depends on the complexity of the case and the stage at which it is resolved. Q2. Are there any hidden costs in no-win no-fee arrangements? Yes, there can be additional costs beyond the lawyer's percentage fee. These may include court filing fees, expert witness costs, medical report expenses, and investigation costs. These expenses are usually deducted from the settlement amount before or after the lawyer's fee is calculated. Q3. What happens if I lose my case in a no-win no-fee arrangement? If you lose your case, you generally won't have to pay your lawyer's fees. However, you might still be responsible for certain expenses like court costs or the opposing party's legal fees. Many lawyers offer insurance to protect clients from these potential costs in case of an unsuccessful claim. Q4. When might a no-win no-fee arrangement not be the best option? No-win no-fee arrangements may not be ideal for cases with unclear liability, low-value claims, or complex legal issues requiring extensive preparation. In these situations, traditional hourly billing might be more appropriate and potentially more cost-effective for the client. Q5. Can I negotiate the percentage a lawyer takes from my settlement? Yes, the contingency fee percentage is often negotiable. It's typically agreed upon and formalized in writing before the lawyer begins working on your case. Don't hesitate to discuss the fee structure with your lawyer and ask for a detailed breakdown of potential costs and deductions.](https://consumersweek.com/wp-content/uploads/2025/06/No-Win-No-Fee-Lawyers-The-Hidden-Truth-About-Settlement-Cuts-870x570.webp)